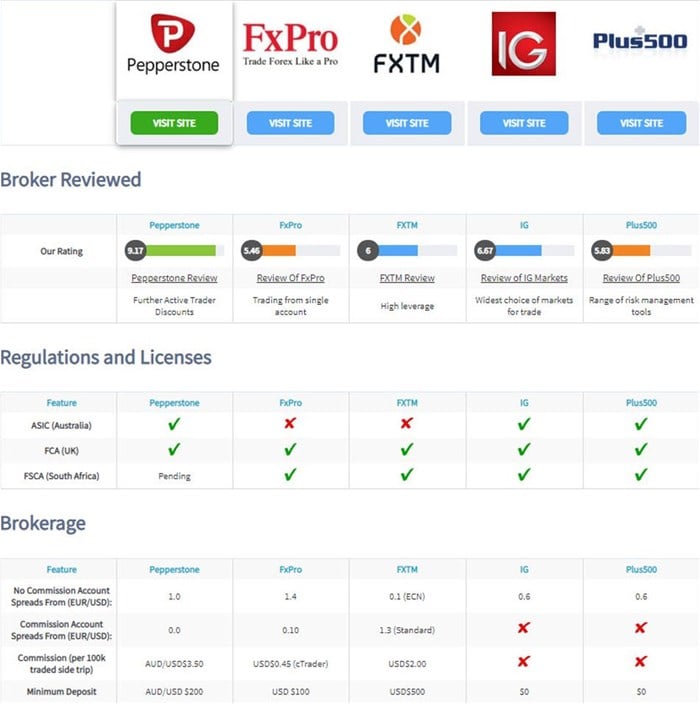

Forex Brokers: Compare Attributes and Costs of Leading Systems

Forex Brokers: Compare Attributes and Costs of Leading Systems

Blog Article

Navigating the Complexities of Forex Trading: Just How Brokers Can Aid You Keep Informed and Make Informed Decisions

In the hectic world of foreign exchange trading, staying informed and making educated choices is necessary for success. Brokers play a critical duty in this complex landscape, supplying proficiency and guidance to browse the intricacies of the market. But exactly how exactly do brokers assist traders in remaining ahead of the contour and making informed selections? By checking out the ways brokers supply market evaluation, understandings, danger management techniques, and technological tools, investors can gain a deeper understanding of just how to properly leverage these resources to their advantage.

Role of Brokers in Forex Trading

In the realm of Foreign exchange trading, brokers play a critical function as intermediaries promoting deals in between investors and the global money market. forex brokers. These monetary professionals serve as a bridge, linking individual traders with the vast and complex globe of fx. Brokers supply a platform for traders to access the market, offering devices, resources, and market understandings to assist in making informed trading decisions

One of the key features of brokers is to carry out trades in behalf of their clients. Via the broker's trading system, investors can sell and purchase money sets in real-time, making the most of market fluctuations. Furthermore, brokers offer take advantage of to traders, allowing them to regulate larger settings with a smaller sized amount of funding. This function can enhance both losses and revenues, making danger administration a critical aspect of trading with brokers.

Additionally, brokers give valuable academic resources and market analysis to assist traders browse the intricacies of Foreign exchange trading. By staying notified concerning market patterns, financial indications, and geopolitical occasions, investors can make tactical choices with the advice and assistance of their brokers.

Market Evaluation and Insights

Offering a deep study market fads and offering useful insights, brokers gear up investors with the necessary devices to navigate the elaborate landscape of Forex trading. Market analysis is an important facet of Forex trading, as it includes checking out different variables that can affect currency rate movements. Brokers play a pivotal role in this by providing investors with up-to-date market evaluation and understandings based upon their knowledge and research.

Through technical evaluation, brokers assist traders recognize historic cost data, determine patterns, and anticipate potential future price motions. In addition, basic evaluation permits brokers to evaluate financial signs, geopolitical occasions, and market news to evaluate their effect on money worths. By synthesizing this information, brokers can provide traders valuable insights right into possible trading chances and threats.

Furthermore, brokers often give market records, e-newsletters, and real-time updates to maintain investors notified regarding the most up to date growths in the Foreign exchange market. This constant flow of information enables traders to make knowledgeable choices and adjust their approaches to transforming market problems. Generally, market evaluation and insights used by brokers are essential devices that encourage traders to browse the vibrant world of Foreign exchange trading successfully.

Risk Management Approaches

Browsing the unstable terrain of Forex trading necessitates the application of robust risk management approaches. Worldwide of Forex, where market variations can happen in the blink of an eye, having a strong threat management plan is important to securing your investments. One crucial strategy is establishing stop-loss orders to immediately shut a profession when it reaches a specific negative cost, restricting potential losses. Furthermore, diversifying your portfolio throughout different money sets and property courses can aid spread risk and shield against significant losses from a single trade.

An additional necessary risk monitoring technique is proper setting sizing (forex brokers). By meticulously establishing the quantity of capital to risk on each trade in percentage to the dimension of your trading account, you can stop catastrophic losses that may wipe out your whole financial investment. Staying educated about international economic events and market information can assist you anticipate potential risks and adjust your trading strategies appropriately. Inevitably, a disciplined strategy to risk management is crucial for lasting success in Foreign exchange trading.

Leveraging Technology for Trading

To properly navigate the complexities of Foreign exchange trading, using advanced technical tools and platforms is essential for enhancing trading approaches and decision-making procedures. One of the essential technical developments that have actually transformed the Foreign exchange trading landscape is the development of trading systems.

Additionally, algorithmic trading, likewise referred to as automated trading, has actually ended up being significantly popular in the Forex market. By using algorithms to examine market problems and carry out professions automatically, traders can get rid of human emotions from the decision-making procedure and make the most of possibilities that emerge within nanoseconds.

In addition, using mobile trading applications has actually encouraged investors to remain linked to the marketplace at all times, allowing them to check their settings, receive alerts, and place professions on the go. In general, leveraging innovation in Foreign exchange trading not just boosts efficiency yet additionally gives traders with important insights and devices to make educated decisions in an extremely competitive market environment.

Creating a Trading Strategy

Crafting a click for source well-defined trading strategy is critical for Foreign exchange investors aiming to navigate the complexities of the market with accuracy and strategic foresight. A trading strategy serves as a roadmap that details a trader's objectives, danger resistance, trading methods, my site and approach to decision-making. It helps traders keep technique, handle feelings, and remain concentrated on their goals amidst the ever-changing dynamics of the Foreign exchange market.

Final Thought

To conclude, brokers play a crucial function in helping investors navigate the intricacies of forex trading by supplying market analysis, understandings, danger management methods, and leveraging technology for trading. you can find out more Their experience and assistance can aid traders in making notified choices and developing efficient trading strategies. forex brokers. By dealing with brokers, investors can stay notified and increase their opportunities of success in the forex market

Report this page